1031 Exchange Timeline

If you decide to execute a 1031 exchange, you must be mindful of key deadlines.

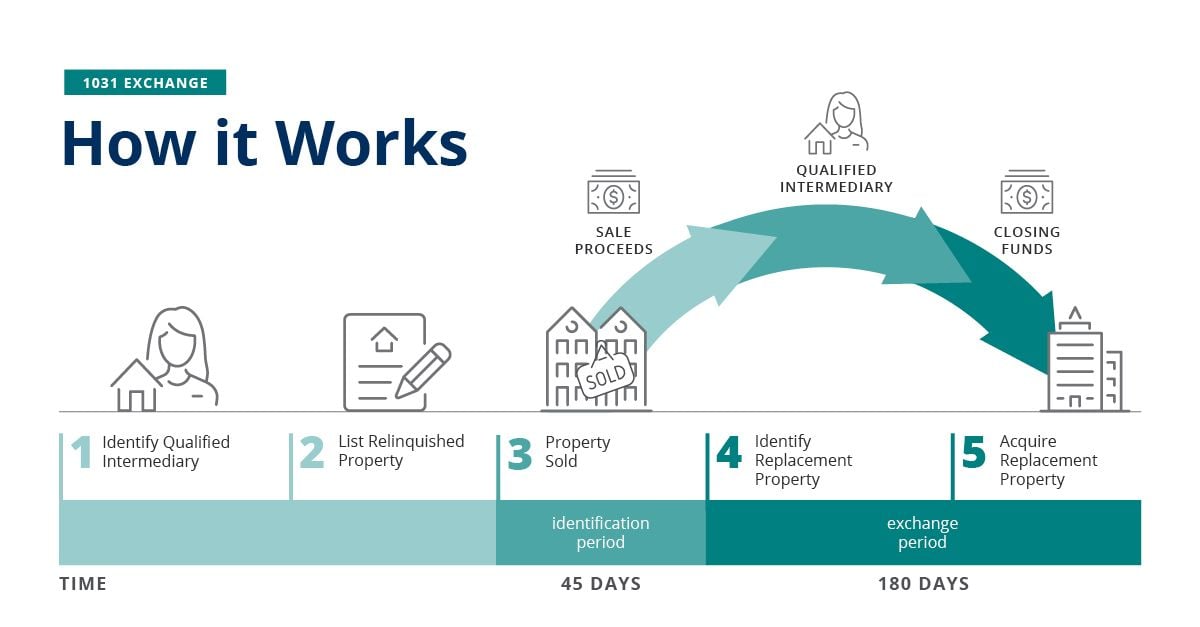

A 1031 exchange follows a specific timeline with two key deadlines:

These deadlines are strict so it’s essential to plan carefully and work with an experienced QI to ensure compliance with these timelines.

180-day Exchange Period: Investors have 180 days to complete the exchange and must close on all intended purchases within 180 days of closing on the sale.

45-day deadline: Within the first 45 days of the 180-day period, investors must identify up to three possible replacement properties. Only these properties qualify for the exchange. Restrictions apply to investors who wish to identify more than three properties.

Important Considerations in a 1031 Exchange

- Consult with a CPA or tax advisor. They know better than anyone whether or not an exchange is the best choice for you. Qualified intermediaries cannot provide any legal or tax advice. Our role is to facilitate the exchange.

- Keep all necessary members of your financial team in the loop. Whether or not you choose Equity 1031 Exchange make sure the QI you do choose has taken the proper security measures with your escrow funds.

- It is never too early to start the process. While we can do exchanges at the last minute, having everything in place in advance makes it easier on all parties handling the transaction. Complete this form to start the 1031 exchange process with our team today.

- Once you are ready to proceed, we send you a client application to complete. You fax this to us with a copy of the contract(s). We take it from there, guiding our clients every step of the way. We make the exchange process as simple as possible for our clients.

Recent Posts

How long does a 1031 exchange take?

Sales Contract For Relinquished Property

You go under contract to sell your existing property.

Complete Application & Contract

Complete our 1031 exchange application and send it to us with a copy of the contract.

Exchange Documents & Closing Instructions

We create the exchange documents for your review and signature. We prepare closing instructions for the title company.

Settlement Statement

Prior to closing, the title company sends the settlement statement for both you and Equity 1031 Exchange to review and sign.

Closing Day

On closing day, proceeds are wired to the escrow account we set up in your name to be held until the closing on the replacement property.

Days 45 & 180

Within 45 days of closing on the relinquished property, you must identify the intended replacement properties. You have 180 days from the relinquished property closing to complete the purchase of the replacement property.

Purchase Contract

Once you are under contract for your purchase(s), we require a copy of the contract(s). We create the final exchange documents for your signature and provide instructions for the title company or attorney handling the closing.

Review, Sign, & Complete

Once it is time to close on your purchase(s), both you and Equity 1031 Exchange will review and sign a copy of the settlement statement. We will wire proceeds to the title company or attorney. When you close on all purchases, your exchange is complete.

SCHEDULE A MEETING

Learn more about 1031 exchanges or get started today: Schedule a virtual meeting with an exchange specialist or call (239) 333-1031.

Getting Started with a 1031 Exchange

READY TO GET STARTED?

If you’re interested in doing a 1031 exchange with Equity 1031, get started here. A member of our team will then contact you within one business day to discuss your 1031 exchange.

Please note: you must set up your exchange before closing on your property. We request three to five business days to set up a Standard Exchange. Contact Equity 1031 Exchange for timelines on setting up a Reverse or Improvement Exchange.

Up next: